1 in 5 Scots still paying off finance for items they don't own anymore

25th September 2014

*Nearly a fifth of Scottish consumers say they are making finance payments for something they no longer own

*The most common agreement to still be paying for is a mobile phone contract

*Upgrading was the reason that most people gave for not owning the item anymore

Almost a fifth of people in Scotland - equating to 950,000 - are still paying off loans or finance agreements for goods that they don't own anymore.

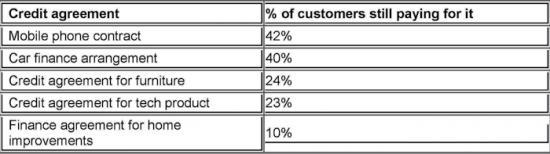

A survey* conducted on behalf of Scottish debt advice and solutions provider Debt Advisory Centre Scotland (DACS) revealed that nearly one in five (18%) of those questioned said they still owe money for items, even though they no longer own them. Mobile phone contracts were the main agreement that Scots still paid for, despite parting ways with the handset.

Of those who said they still pay for their previous mobile phone contract even though they no longer own the phone, around four in 10 (43%) said they had upgraded their device before the repayments on the old model had been completed. Another four in 10 (40%) admitted to breaking their mobile phone and buying a new one, while one in 10 (11%) said that their device had outlived its predicted usefulness.

More than half (57%) of respondents who bought a car on credit but don't own the vehicle anymore said that they had upgraded to a newer model, even though they were still paying off the previous one. Breakdowns were also an issue, with a fifth (21%) having to buy a new vehicle while they are still paying for their old - and broken - car. Furniture was another popular item that respondents had taken out a credit agreement for, only to still be paying for it when it was no longer in their possession. A third (37%) said that their furniture purchase had become worn out and was no longer useful, leading them to simply buy a new one. Tech purchases were close behind, with four in 10 (39%) saying they had upgraded their hardware but still had to make payments on their old technology.

Products like cars or furniture bought through a hire purchase agreement or similar officially belong to the lender until the last full payment is made, which can make ending the contract by selling the item very difficult, if not impossible. With this in mind, it is always advisable to check the small print on the contract before parting with the product.

Ian Williams, spokesman for DACS, says: "When many of us are tightening the purse strings, an extra payment isn’t likely to be welcomed by anyone, especially if you don’t even own the item anymore. An extra debt for people who are already struggling with their finances is especially worrying, as it could lead to missed payments and a negative effect on their credit score.

“Hopefully, these findings will encourage customers to be more aware of the problems that longer term credit agreements can bring, and take more care deciding how long they are really likely to need an item for before purchasing it on credit."