Students Should Swot Up to Make Savvy Financial Decisions

19th August 2014

Cash strapped students preparing to start university should check their finances to ensure they're getting the best possible deals, advises MoneySuperMarket.com.

Current accounts - don't over-do your overdraft

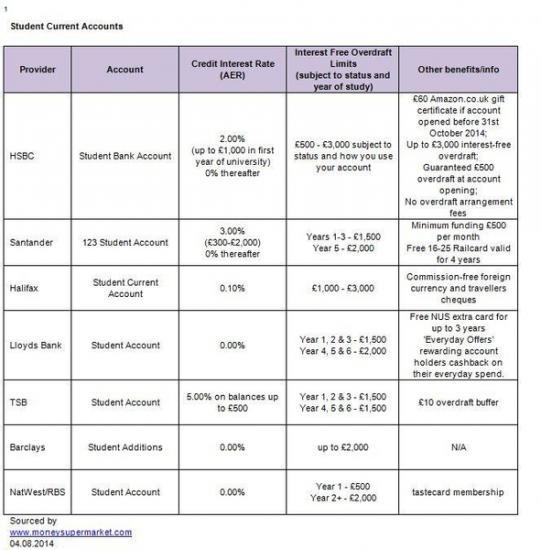

Many students will end up relying on an overdraft to make ends meet between loan payments, so securing one with a decent limit is crucial. The limit your are offered depends on your circumstances and who you choose to bank with for example, HSBC and Halifax offer interest free overdrafts of up to £3,000 over the duration of your course. Depending on circumstances, not every person will get the full amount and for most it will be increased gradually from a smaller starting point.1

However, it's vital to do a budget to work out how big an overdraft you need, then not borrow more than that - it will have to be paid back eventually!

Zero per cent deals on overdrafts tend to expire after graduation, so students need to plan how they are going get themselves back into the black, sort out a short term interest free graduate overdraft or, could risk facing additional interest payments.

In addition, anyone likely to go over their authorised overdraft would benefit from getting clued up on the costs of doing so beforehand. The amount charged for using an unauthorised overdraft varies greatly across providers. For example, TSB has an 8.21 per cent EAR for its student account, while Halifax charges 24.2 per cent. Other providers, such as Santander, charge a one off payment of £5 per day, capped at 5 days per month.

Enjoy the freebies, but don't let them cloud your judgement

Most providers offer a number of benefits such as Young Persons Railcards, NUS Extra discount or Amazon vouchers. Although useful, the value of freebies will be low compared to getting the largest interest-free overdraft, which should be the key focus for those considering a student account.

Clare Francis, editor-in-chief at MoneySuperMarket.com, said: "Students gearing up for the start of university may be more focussed on what lies ahead in fresher's week than their finances which is completely understandable. But what about things like internet access, your bank account and protecting your possessions? They might seem boring but before heading off to start the next chapter in life, it is worth spending a bit of time making sure you've got these things sorted. Not only does it give peace of mind, but getting the best deals could also save money, which means there's more to spend on other things like socialising."

Best broadband

The majority of students starting or returning to university in September will be moving into either student halls or privately shared accommodation. Whilst those in halls may have the option to pay for broadband through their place of study, those in private accommodation will need to shop around for their broadband needs.

There are a number of deals which are specifically tailored for students such as POP Telecom's Unlimited Broadband which costs £13.50 per month including line rental which gets you 16Mbps speed and unlimited usage. Based on four students sharing responsibility of the bills, this could cost as little as £3.38 each per month.

For a speedier connection, plus the ability to make calls at weekends, Virgin Media Student Broadband with Talk Weekends costs £31.49 per month including line rental - or £7.87 per month between four students. It offers a massive 50Mpbs speed, unlimited usage and free weekend calls plus a contract period of just nine months compared to a 12 month tie-in required by other providers. This means you are less likely to pay for broadband you won't be using out of term time when many students return home.2

Insuring your possessions

Many students will be taking gadgets to university with them such as mobile phones and laptops, making contents insurance crucial for those moving away. Whilst standalone policies are available, they can be costly therefore; parents should check whether their own home insurance will also cover their children who are planning on studying elsewhere. Some insurers will offer cover to students away from the home on a parent's existing policy with providers such as Marks & Spencer offering unlimited cover on its Premier home insurance.

Clare Francis concluded: "With the average graduate debt expected to reach a huge £44,000 it is more necessary than ever for students to shop around for the best deals to save cash, including on the insurance policies they will need if living away from home.3 It's vital to take out adequate cover to protect belongings such as iPads, laptops and mobile phones which will be a prime target for theft. One way to bring down the cost for this cover is to add students onto their parent's home contents policy. Parents should be aware however, that any claims made will directly impact their own claims history and potentially result in increased premiums in the future.